The ideas which are here expressed so laboriously are extremely simple and should be obvious. The difficulty lies, not in the new ideas, but in escaping from the old ones, which ramify, for those brought up as most of us have been, into every corner of our minds.

John Maynard Keynes

Of all the critiques of mainstream economics, Third World, feminist, Austrian, radical, Georgist, Marxist and others, the one our grandkids would have us heed most is the ecological critique. The ecological critique says that mainstream economics has ignored some extremely important scientific principles that are especially relevant to economic growth in the 21st century. These principles, taken together, make it abundantly clear that there are limits to population growth and to the production and consumption of goods and services, no matter how efficiently we try to produce and consume. In other words, these principles make it clear that there is a limit to economic growth. Therefore, a full world in pursuit of economic growth finds itself in violation of the laws of nature and is penalized accordingly. As they say, ?Nature bats last.? Unfortunately, the penalties will be most severe for the grandkids, and this will be supremely unfair because the grandkids will have had no say in the formulation of our economic goals.

The ecological critique of mainstream economics is so strong and compelling that a large and growing academic movement has formed around it. This movement is called ?ecological economics,? no less, and is more or less embodied in the International Society for Ecological Economics, or ISEE.1

There are ISEE chapters representing the United States, Canada, Europe, Russia, Australia and New Zealand, Brazil, Argentina, and India.

As with most movements, there are various views on how ecological economics originated. However, at least three couplings of people and their thought-provoking writings would be prominent in any discussion of ecological economics history. One is the controversial book by Donella Meadows, Dennis Meadows and Jorgen Randers called Limits to Growth, published in 1972. Another is the highly theoretical work of the Romanian professor Nicolas Georgescu-Roegen, summarized in his book The Entropy Law and the Economic Process (1971). The third would be the profound but down-to-earth work of Herman Daly on the steady state economy, featured in books such as Valuing the Earth (1993), For the Common Good (1994) and Beyond Growth (1997).

Limits to Growth was a cornerstone of the American environmental movement and was eventually translated into 30 languages.

The authors, based at the Massachusetts Institute of Technology(MIT) and commissioned by the Club of Rome, developed a computer model demonstrating how economic growth was leading to natural resource depletion and environmental degradation. Two of the computer scenarios, including a ?business as usual? scenario and a dramatic technological progress scenario, predicted a disastrous collapse of the economy during the 21st century. The third scenario was essentially the steady state economy and assumed concerted efforts to stabilize the system. The book and its authors suffered a politically debilitating attack in the decades following its publication. At first, economists in academia chipped away at details, but soon pro-growth, free-market organizations such as the Competitive Enterprise Institute and Cato Institute piled on with an overarching accusation of ?pessimism.? Such criticism was similar to the 19th-century criticism of Malthus?s Essay on Population and is hard to read without countering: ?Don?t throw the baby out with the bathwater.? Perhaps Meadows and her colleagues weren?t spot-on with every detail, but the principles they laid out were undeniable and the scenarios were rigorously constructed. Decades later analysts are documenting how prescient the authors of Limits to Growth were, especially with the business as usual scenario.2

In contrast to Limits to Growth, Georgescu-Roegen?s masterpiece went mostly unnoticed in academia and was entirely ignored in public dialog. It?s effect has been like the hands of time, tick-tocking perpetual growth notions into the dustbin of yesteryear?s fantasies. The slow but sure ticking is apropos, given that The Entropy Law and the Economic Process is all about ?time?s arrow,? or the entropy law.

The entropy law is a foundational concept in physics: the second law of thermodynamics no less. Perhaps the quickest, easiest way to describe it is that energy inevitably, invariably dissipates.

Things that are hotter than their environment cool off. Of the billions of cups of coffee poured in the broad sweep of history, not one has warmed up of its own accord, not for an instant. The entropy process is as consistent and irreversible as Father Time; you can tell whether it?s earlier or later based on the warmth of your coffee. Einstein said of the entropy law, ?It is the only physical theory of universal content, which I am convinced . . . will never be overthrown.? Einstein was also impressed by the entropy law?s ?range of applicability.?3

And apply it Georgescu-Roegen did, unto 457 pages! The main application, in a nutshell, is that absolute efficiency in the economic production process cannot be achieved. Nor can recycling be 100 percent efficient. Pollution is inevitable, and all else equal, more economic production means more pollution. These findings may seem like no-brainers to many, yet neoclassical growth theory has led to wild-eyed optimism regarding ?green growth? and ?closing the loop? by turning all waste into capital. Such fantasia cannot be soundly refuted without invoking the entropy law.

The Entropy Law and the Economic Process moves across a huge swath of philosophical and scientific terrain. As with most wide-ranging and intellectually adventurous books, The Entropy Law can and has been challenged. Most of its arguments and the counterarguments are philosophical and not amenable to scientific proof or disproof. But the tremendous value of The Entropy Law is that it unequivocally established the profound relevance of thermodynamics to economic affairs. Unlike neoclassical economics, ecological economics embraces this relevance, putting ecological economics into a better position for enlightening real world affairs.

With regard to real world affairs, though, The Entropy Law as a book was not as useful as the entropy law itself. It was abstruse enough to appear esoteric, and Georgescu-Roegen?s interests in economic affairs tended to be exceedingly long-term. While neoclassical economists pushed a perpetually growing economy, Georgescu-Roegen emphasized a perpetually eroding economy and indeed a perpetually eroding universe, all the way out to the ?heat death? necessitated by infinity. This emphasis had the ironic effect of retarding the application of The Entropy Law and the Economic Process to the economic process itself.

Fortunately for ecological economics, one of Georgescu- Roegen?s students at Vanderbilt University was Herman Daly. A devout Christian, Daly too had an eye toward the longest of long terms, but he also had one eye focused on the wellbeing of present and upcoming generations. This tapestry of long- and short-term interests can be sensed throughout Daly?s writings. Daly took the entropy law, emphasized its short-term relevance while acknowledging its long-term implications, and used it as part of a well-grounded macroeconomic framework. He called this framework ?steady state economics,? which served as the catalyst for the ecological economics movement. Much of the remainder of this book is a natural progression from Daly?s steady state economics.

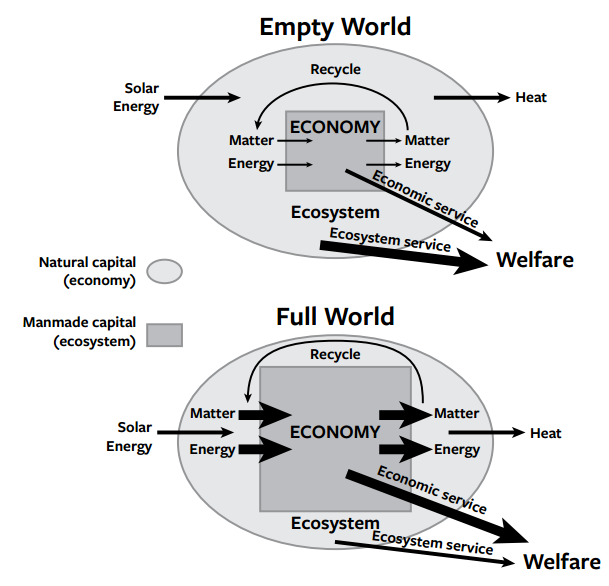

Figure 6.1. Herman Daly (top left) and Donella ?Dana? Meadows (top right), founders of ecological economics. Daly and colleagues clarified the relationship between the economy and earth with a diagram (above) that was simple but powerful for illustrating limits to growth. Credits: (top left) Herman Daly; (top right) Donella Meadows institute; (above) From Ecological Economics, Herman e. Daly and Joshua Farley, ?2004 Herman e. Daly and Joshua Farley. reproduced by permission of island Press.

With the passing of Georgescu-Roegen (1906?1994) and Donella Meadows (1941?2001), of the three only Daly, a professor emeritus with the University of Maryland, remains a major figure in ecological economics.4

For the Common Good (co-authored with the theologian John Cobb) received the prestigious Grawemeyer Award for Ideas Improving World Order. Daly was also the recipient of the Honorary Right Livelihood Award (Sweden?s alternative to the Nobel Prize) and the Heineken Prize for Environmental Science from the Royal Netherlands Academy of Arts and Sciences. Daly is no ivory-tower academic, either, having spent six years as a senior economist at the World Bank. The National Council for Science and the Environment presented Daly with its Lifetime Achievement Award in 2010. The tremendous respect for Daly is displayed in a festschrift authored by colleagues, students and admirers.5

Of course, it is somewhat arbitrary to classify these relatively recent efforts as the ?roots? of ecological economics. We saw in Chapter 3 that the classical economists, most notably Malthus, recognized limits to economic growth. John Stuart Mill went further and elaborated on the ?stationary state.? Daly?s steady state economy is essentially the resurrection of Mill?s stationary state, supplemented with a rigor gleaned from the natural sciences, an economic mastery honed in academia and first-hand experience with economic growth policy as implemented by the World Bank. After six years at the Bank, Daly left in disgust, noting the blind faith in neoclassical economics among the Bank?s highest-ranking economists.6

He offered the hopeful observation, however, that the Bank was becoming ?more environmentally sensitive and literate.?7

Daly was modest, for the newfound environmental sensitivity wasn?t foisted onto the Bank by Wall Street or the Competitive Enterprise Institute. In fact, we have the likes of Daly himself and a noteworthy colleague at the bank, Robert Goodland, to thank.

With that brief historical account as background, the remainder of this chapter will comprise an overview of ecological economics, with an emphasis on how ecological economics treats the subject of economic growth. As with conventional economics, ecological economics can be broken down into micro- and macroeconomics.

Ecological economics is founded upon different principles, micro and macro, which lead to distinct conclusions and policy implications. These principles stem from the natural sciences (physical and biological) that are largely ignored in conventional or neoclassical economics.

While we keep the micro-macro distinction in mind, it will also be useful to think of three themes: allocation, distribution and scale. ?Allocation? refers to the way the factors of production are devoted to different producers for different purposes. For example, land may be allocated among farming, forestry, recreational and other uses. Labor and capital may be allocated likewise. At a finer level, timber from a forest may be allocated among furniture-making, construction, boat-building, etc. Labor at the construction site may be allocated among carpentry, masonry and plumbing.

Capital at an automobile plant may be allocated among the chassis, drive-train and circuitry floors. The efficiency of an economy depends to a great extent upon a well-balanced allocation among and within the factors of production.

?Distribution? refers to the distribution of income, wealth or general welfare. This is the economic subject most often discussed by non-economists. Indeed, politics is mostly about distribution, which explains the classic definition of politics: ?Who gets what, when, and how.?8

Bill Clinton could have elaborated, ?It?s the political economy, stupid!?

?Scale? refers to the size of the human economy relative to the ecosystem. This, of course, is our focus here, and it provides the primary distinction between neoclassical and ecological economics. Neoclassical economics deals almost exclusively with allocation and, to a much lesser extent, distribution. Why? Because neoclassical economics doesn?t recognize environmental limits to economic growth. With no limit to growth, the concept of scale is superfluous, there is no conflict between growth and the environment, and the cure for social ills including maldistribution of wealth is always more growth. ?A rising tide lifts all boats,? as they say.

Ecological economics deals with allocation and distribution, but its emphasis is on scale, especially among the scholars and policy activists we might call ?Dalyists.? Scale deals with whole economies, usually national or global, so ecological economics is geared especially to replace conventional macroeconomics while accepting and incorporating some of the fundamentals of conventional (neoclassical) microeconomics. Before we delve into scale, however, let us briefly consider allocation and distribution from the perspective of ecological economics.

Ecological economists acknowledge that the market that ubiquitous place where goods and services are exchanged is reasonably efficient at allocating resources. The market is especially efficient when property rights are easily established and readily enforced. This is not the same as saying prices are a good indicator of absolute or long-run scarcity. For example, even if the market price of petroleum is far too low for the sake of the grandkids, allowing us to pull the carpet from under their future, the market will do a reasonably good job of allocating petroleum among today?s power plants, airlines and trucking companies. For example, there won?t be a huge surplus of petroleum at the power plant if the trucker down the road is desperate for gas. The fact that the invisible hand can handle this allocation problem is good indeed. Today?s consumers will not only have electricity from the power plant, but goods hauled in by the trucker.

Adam Smith described this process in detail but also noted several problems, including monopolies and misinformed consumers. Such problems prevent the market from performing properly.

Few have argued that point, and economists of all stripes talk about ?market failure? and how to correct it. Nevertheless, neoclassical economists place a notorious amount of faith in the market. The invisible hand, they say, ensures that microeconomic behavior produces a desirable macroeconomic outcome. Supply and demand establish prices that send appropriate signals to producers and consumers, leading to economic activity that serves society?s interests. For example, as a natural resource becomes scarcer, the price of it rises, resulting in more vigorous efforts to supply the resource.

Theoretically, this will take care of the grandkids as well as today?s consumers. Richard Norgaard, a professor at the University of California, Berkeley and past president of the ISEE, points out the fallacy inherent to the neoclassical theory of prices.9 The theory implies that she who sells the resource knows whether the resource is scarce or not. Otherwise, how would she know where to set the price? Yet how was she supposed to know how scarce the resource was, if price was supposed to tell her? It?s a catch-22.

This is an important critique, because economists often argue that natural resources are actually becoming more plentiful just because prices are declining. (Not that many prices are declining today.) The late Julian Simon (1932?1998) famously peddled such pap, spawning disciples who found Simon?s argument conducive to increasing their own money supplies. After all, their ?theory? feeds straight into the hands of corporations that benefit from the resulting, pro-growth mindset of consumers and policy makers. The corporate community loves these disciples of Simon, and the new darling is the Danish statistician Bjorn Lomborg. Praise has been heaped upon Lomborg by the likes of the Competitive Enterprise Institute for his book, The Skeptical Environmentalist(see Chapter 4).

Yet for ecologists, ecological economists and sustainability thinkers, The Skeptical Environmentalist is riddled with fallacies, straw men and shoddy scholarship. I agree with them, having carefully reviewed the book for the journal Conservation Biology,10 and websites have been devoted to exposing Lomborg?s misinformation.

Yet we saw in Chapter 4 how such books can be paraded by Big Money. In the process, their popularity may eclipse their notoriety, especially among the uninitiated, the gullible or those desperately wanting to believe that all is well, after all, in the environment. George Will comes to mind.11

But back to Norgaard, whose observation on the fallacy of pricing theory helps explain the confusion of economics students when they encounter the subject of supply and demand in introductory ?micro.? First they learn that prices are determined by supply and demand. Then they learn that the quantities supplied and demanded are determined by. . . prices. There happens to be no lurking inconsistency here. But there?s no magic trick to dazzle us either. It?s just a matter of semantics. Supply is not the same as ?quantities supplied? and demand is not the same as ?quantities demanded.? But these semantics do open the door for shenanigans.

The supply (per se) of raw diamonds, for example, is determined primarily by how many diamonds are in the ground and the technology available for mining them. Supply clearly does influence price; diamonds are expensive partly because they are so hard to find and extract. On the other hand, the ?quantity supplied? is what is brought to the market by diamond sellers. Price clearly does influence the quantity supplied; the higher the price, the higher the quantity supplied, all else equal.

So the relationships among supply, price and quantity supplied are really not so mysterious, at least not until a linguistically reckless or unscrupulous growthman wades in to muddy up the waters. The late Julian Simon has plenty of living counterparts. Robert Bradley, president of the Institute for Energy Research, believes that ?natural resources originate from the mind, not from the ground, and therefore are not depletable. Thus, energy can be best understood as a bottomless pyramid of increasing substitutability and supply.12?

In other words, innovators supply the world with natural resources, including energy, from their minds. Therefore, the supply of such resources is no problem.

Clearly such a theory inculcates a healthy supply of manipulative political rhetoric, in which the word ?supply? is quickly corrupted. It?s a game anyone can play, so let?s take a turn. Consider the supply of clean air at a party in an apartment. Smokers suck in the clean air and gradually replace it with secondary smoke. Their lungs are like pumps in an oilfield, systematically extracting the resource, replacing it with airborne sludge. As more smokers arrive, the supply of clean air noticeably dwindles, and non-smokers start to leave. Eventually even the smokers start leaving, beginning with the lighter smokers who don?t like heavy smoke. So at first, more smokers means a lower supply of clean air, yet eventually after enough smokers have polluted the place and many have left the supply of clean air stabilizes. In fact the supply of clean air starts to increase a bit as the secondary smoke is absorbed in the curtains and carpeting, and fresh air wafts in through fissures in the walls(assuming smokers weren?t crowding the hallways outside). Next, we conveniently overlook the fact that it took a major reduction of clean air to make all this happen; too complicated to consider all that. So in a squirrelly sort of way we can now say that more smoking (that is, extraction of clean air) led to increasing supplies of clean air, and indoor air pollution due to smoking is a self-correcting problem. If we generalize a bit, moving out of the confines of this particular party, we can say that the key to less smoking in society is more smoking!

This ludicrous example mirrors the claim that the invisible hand of the market will ?fix? any resource shortages that might arise. It?s smoke-and-mirrors.

We?ve all been downwind of cigarette smoke. Certainly we have the right to poke a little fun, especially at the ?Seven Dwarves,? the CEOs of America?s largest tobacco companies, who perjured themselves before a US House of Representatives Subcommittee: ?I believe that nicotine is not addictive.?13 The resulting news broadcast was unforgettable to many Americans, who learned a lot about Big Money that day. We fully expected the Seven Dwarves to announce, as an encore, the Tooth Fairy?s engagement to Santa Claus.

So Americans know quite well how Big Money pollutes the truth. Can we expect the mother of all money-making theories, neoclassical growth theory along with all its crazy correlates to come to us on wings of truth? Sure, sure, higher prices stemming from lowered supplies actually ?increase? supplies because they provide an incentive to ?supply? even more. And more smoke makes the air ?cleaner? by providing an incentive for smokers to increase the supply of clean air. More traffic increases the supply of open road. More noise actually leads to a greater supply of quietness. Less of a good thing leads to more of it! More of a bad thing leads to less of it! Or, if you prefer, less of a good thing leads to less of a bad thing, and more of a bad thing leads to more of a good thing!

So if the Competitive Enterprise Institute, neoclassical economists and growthmen at large want to claim that oil supplies, for example, are actually increasing, not decreasing, as evidenced by the occasional downturn in price, let them play with the word ?supply? like the Seven Dwarves play with ?addictive.? Let them use ?supply? to mean more, less, a harmless mess, anybody?s guess . . . whatever. But may the rest of us not be dolts. Supply is how much there is, and as you use more, less remains.

Meanwhile, expecting the market to maintain our supplies is like expecting the political arena to maintain our ethics, the library to maintain our ideas or the sewage plant to maintain our intestinal tracts. Each of these pairings represents a relationship between two variables, but in no case is the relationship straightforward or dependable, much less positively reinforcing. Thus it is with market prices and supplies. The bottom line is that markets are all about the consumption of resources. No matter how efficiently they allocate resources today, bigger markets mean more consumption and less resources tomorrow.

Now we turn to the distribution of wealth. Many neoclassical economists view the distribution of wealth as a final stage or special case of allocation and therefore ?covered? by the market. Others think of distribution as a matter for politics, ethics or religion and not even within the purview of economics. Ecological economists, on the other hand, emphasize that an equitable distribution of wealth is necessary for the long-term economic security of rich and poor alike, and is therefore a central issue for economic study and policy. In fact, distribution of wealth generally takes a higher priority than allocation in ecological economics. Ecological economists also emphasize the distinction between allocation and distribution. Just because a consumer purchases something when he thinks the transaction will benefit him doesn?t make the market equitable at distributing wealth. In fact, the market has little to do with the distribution of wealth. Wealth (in the economic sense) is the means to purchase and affects the amount that may be purchased. Wealth may be legitimately worked for and even invested in, so that labor markets and stock markets are conduits for wealth, but large portions of wealth are distributed via charity, inheritance, marriage, luck and shades of crime ranging from shoplifting to Enron. A whole subfield of ecological economics has sprung up around the distribution of wealth as distinct from the allocation of resources.

In considering the distribution of wealth, a good starting point is human behavior. Remember from Chapter 2 the neoclassical notion of self-interested, utility-maximizing Homo economicus, whereby utility is expressed in terms of consumption? This materialistic model of mankind is roundly condemned by assorted critics, often with Marxist or Georgist leanings, and more often with common sense. Ecological economics offers an additional, unique and original critique in which humans are viewed as having evolved in a variety of ecosystems, each of which posed unique constraints on economic behavior and resulted in unique cultural norms. As such, humans are subject to diverse, complicated, and even mysterious motives not satisfied by simply maximizing their consumption of goods and services. This way of thinking is called ?evolutionary economics? in some circles.

Don?t worry, this book is not about to turn into a Luddite manifesto for turning back the clock to caveman days. But it?s worth thinking about human nature, the deeply rooted, promising aspects of human nature with economic growth at the crossroads. We know that people the world over have cultural, tribal roots and urges, exposed most obviously in outdoor activities such as hunting, fishing and camping. Is there something deeper? Surely there is, especially traits, behaviors and attitudes that would have contributed to individual and tribal survival. We should at least attempt to identify some of the ways human evolution has affected our economic behavior today, rather than settling for a model that makes us look like pigs at a trough?

This is an excerpt from Chapter 6 of ?Supply Shock: Economic Growth at the Crossroads and the Steady State Solution? by Brian Czech, published by New Society. The Chapter is also available for download. We will be publishing Part 2 of this excerpt shortly.

New Society Publishers

Source: http://peakoil.com/generalideas/supply-shock-ecological-economics-comes-of-age

palestine Zig Ziglar alabama football sean taylor Lisa Robin Kelly Nexus 4 Girl Meets World

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.